Kambi Group plc repurchase of shares 3 November – 10 November 2021

Kambi Group plc has completed its inaugural share buyback programme ending on 10 November 2021 within the mandate approved at the Extraordinary General Meeting on 23 June 2021.

During the period 3 November to 10 November 2021, Kambi repurchased a total of 241,000 shares at a volume-weighted average price of 231.26 SEK per share. The objective of the buyback was to achieve added value for Kambi´s shareholders. The buyback programme, which Kambi announced on 27 October 2021, is now complete and was carried out in accordance with the Maltese Companies Act and other applicable rules.

From the programme start on 27 October until and including the end of the programme on 10 November, Kambi has repurchased a total of 523,500 shares at a volume-weighted average price of 227.77 SEK per share. In total, a maximum of 3,097,570 shares were allowed to be repurchased with a total maximum value of up to EUR 12 million.

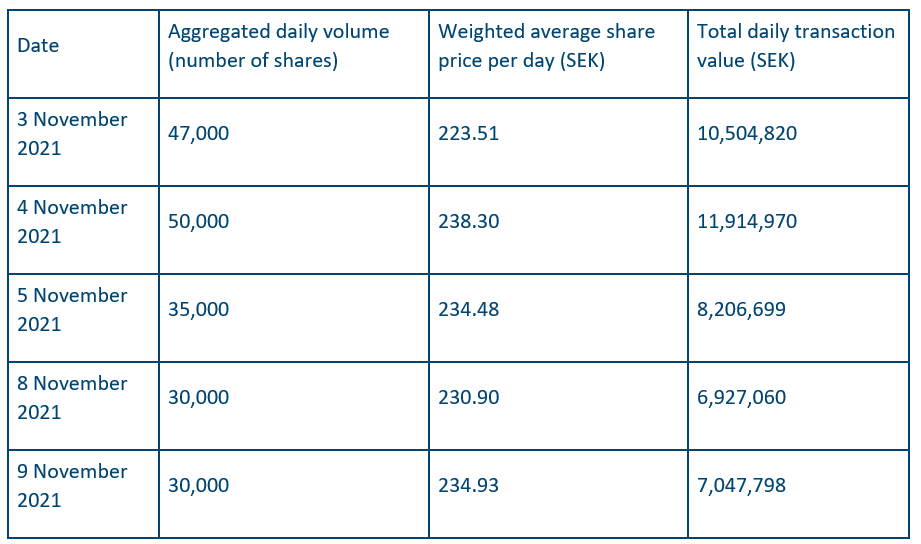

During the period 3 November 2021 until 10 November 2021, shares in Kambi have been repurchased as follows:

All acquisitions have been carried out on Nasdaq First North Growth Market in Stockholm by Carnegie Investment Bank AB on behalf of Kambi. Following the acquisitions and as of 10 November 2021, Kambi’s holding of its own shares amounted to 523,500 and the total number of issued shares in Kambi is 31,058,797.

For information about all transactions carried out under the buyback program, please see Nasdaq Stockholm’s website: http://www.nasdaqomx.com/transactions/markets/nordic/corporate-actions/stockholm/repurchases-of-own-shares

Information on the buybacks is available on Kambi’s website, www.kambi.com.